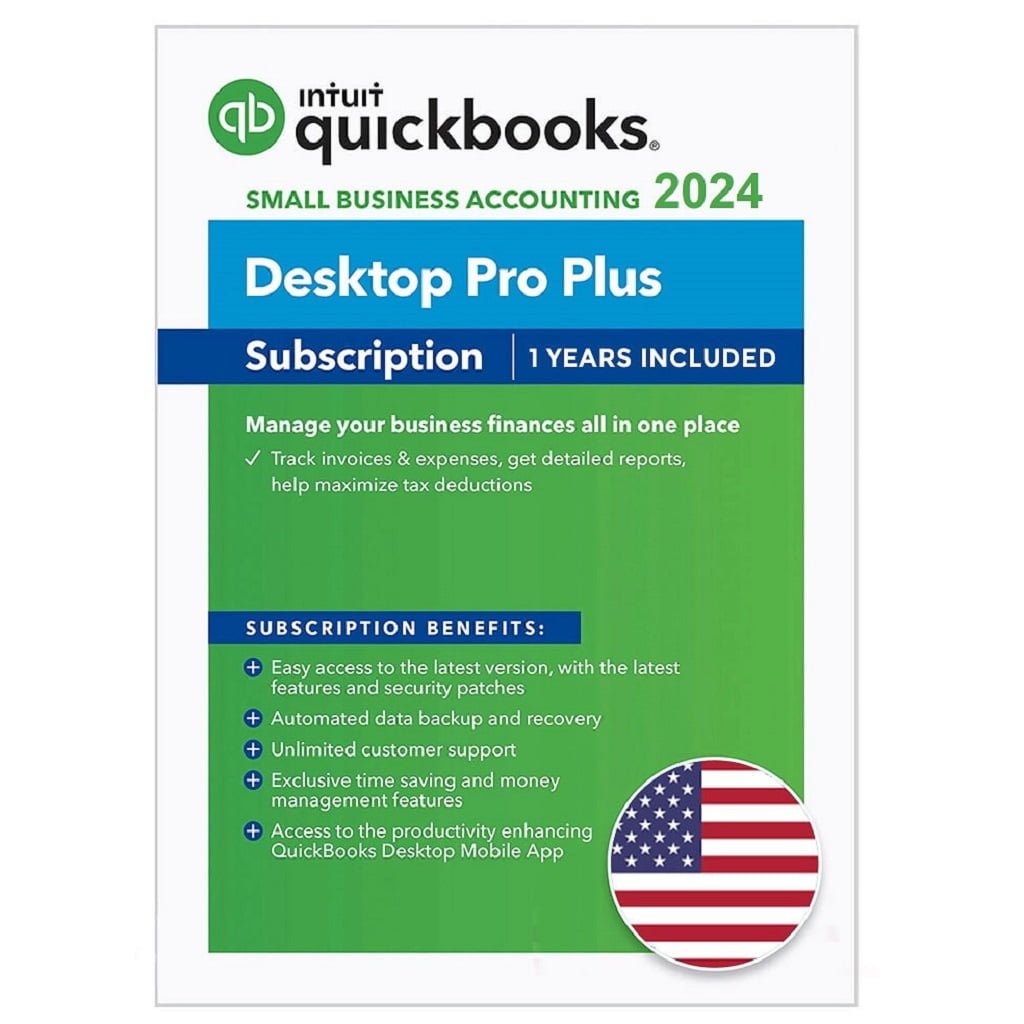

QuickBooks Desktop Pro Plus 2024 Software 1 Year Subscription for windows

- “This software subscription expires after 12 months starting date of activation and is not automatically renewed. Use your account settings to manually renew your subscription.“

How You Will Get Your Product:

Instant Activation:

Upon making your purchase, you’ll receive instant activation with:

- The official product download link.

- The original key to activate the product without any issues.

License Key Format:

- License Number: XXXX-XXXX-XXXX-XXX

- Product Number: XXX-XXX

System Requirements And Technical Details :

- Operating System: Windows 10 (all 32-bit & 64-bit versions), or Windows 11, Windows 8.1.

- Processor: Minimum 2.4 GHz processor (4 GHz recommended).

- RAM: Minimum 4 GB (8 GB recommended).

- Disk Space: 2.5 GB of free disk space (additional space required for data files).

Manage your business finances all in one place:

- Track invoices & expenses, get detailed reports, help maximize tax deductions

- Additional productivity and industry specific tools

QuickBooks Desktop Pro plus 2024. Upgrade to QuickBooks Pro 2024 with our exclusive 1 year subscription offer! Gain unlimited access to the industry-leading accounting software tailored for large businesses, without worrying about recurring subscription fees. With QuickBooks Pro, you’ll unlock advanced features such as customizable reporting, inventory tracking, payroll processing, and more, empowering you to streamline your financial management processes effectively. Take advantage of our subscription to enjoy long-term cost savings and uninterrupted access to the most comprehensive accounting solution in the market. Invest in your business’s future with QuickBooks Pro and experience unparalleled efficiency and scalability.

Key Features:

- 1 year access to QuickBooks Pro software

- Comprehensive financial management tools

- Customizable reporting for in-depth insights

- Advanced inventory tracking capabilities

- Dedicated customer support

- Advanced User Permissions

Subscription Benefits:

- Easy access to the latest version, with the latest features and security patches.

- Automated data backup and recovery.

- Unlimited customer support

- Exclusive time saving and money management features.

- Access to the productivity enhancing QuickBooks Desktop Mobile App.

Upgrade to QuickBooks Desktop Pro with a subscription today and revolutionize your business’s financial management. Contact us now to learn more and take advantage of this exclusive offer!

Intuit QuickBooks Desktop Pro 2024, the US version, represents the pinnacle of ERP software solutions for businesses. With its advanced features and user-friendly interface, it empowers businesses to streamline their operations, manage finances effectively, and drive growth. From inventory management to financial reporting, it’s offers comprehensive tools tailored to the specific needs of US-based businesses. Its robust functionality and scalability make it the ideal choice for enterprises looking to optimize their enterprise resource planning processes. With Intuit QuickBooks Desktop Pro 2024, businesses can gain valuable insights, make informed decisions, and stay ahead of the competition in today’s dynamic market landscape.

What's New in QuickBooks Desktop Pro Plus

Features included with QuickBooks Desktop

- Organize finances

- Track performance

- Track performance

- Includes up to 3 users

- Income & expenses

- Invoice & accept payments

- Tax deductions

- Reports

- Receipt capture

- Sales & sales tax

- 1099 contractors

- Managing multiple companies

- Businesses that prefer desktop software

QuickBooks Desktop Features

QuickBooks Desktop doesn’t fall short in terms of A/P features, but we found the A/P module difficult to use. While you can enter bills and vendor credits easily straight from the A/P register, the process can be difficult to follow for nonaccountant users.

However, despite this minor issue, Pro offers almost all the A/P features we look for in accounting software. It allows you to enter bills as you receive them and then pay them later. You can record a new bill from the

Enter Bills window in QuickBooks Desktop Pro

QuickBooks will include the unpaid bills in your expenses if you choose to print an accrual-basis income statement—but not if you print a cash-basis income statement. You can track outstanding bills until they’re paid and set up recurring expenses, which is useful when you have regular monthly bills to pay, such as subscription fees.

Based on our subjective evaluation, QuickBooks Pro’s A/R module wasn’t as easy to use as we expected—hence the slight blow to its score. However, the program offers a solid A/R management solution.

There are three ways you can create an invoice in QuickBooks Desktop Pro: from scratch, a sales order, or an estimate. When creating an invoice from an estimate, you can either convert the entire estimate to an invoice or choose a selected item or percentage to invoice, which is called progress invoicing.

Create an invoice from an estimate in QuickBooks Pro

To help you stay on top of your A/R, Pro has an income tracker that monitors overdue and almost overdue invoices and sends email reminders of due payments to your customers.

The platform earned a perfect score in this criterion because of its comprehensive bank reconciliation feature that’s comparable to QuickBooks Online. You can set up a bank feed for your checking and credit card accounts to transfer transactions automatically. After the transfer, you can review the information and make changes prior to adding it to your account register.

Classifying bank transactions in QuickBooks Desktop Pro

One thing we like about QuickBooks Desktop is that you can combine multiple cash and checks into a single deposit, which is a very useful feature if you accept multiple checks daily.

QuickBooks Pro has all the ideal project accounting features, including the ability to create an estimate, attach items (like inventory and sales taxes when creating an estimate), and allocate costs and estimates to a project. QuickBooks Desktop is better at project accounting than QuickBooks Online because of its ability to compare actual costs to estimates, which is an important feature for contracting companies.

You can create a project, or “job” as QuickBooks calls it, for a customer to track your income and expenses by job. You can monitor the progress of the tasks involved in a project and even compare your actual to planned costs and progress so that you can easily identify issues that might affect your schedule and budget. This provides project managers meaningful insights into what and how much work has been done and whether the project can be completed on time.

You can access the New Job screen from the Customer Center window under the Customers menu. The New Job screen menu includes four sections to complete: Address Info, Payment Settings, Additional Info, and Job Info.

Typically, the address info and payment settings are automatically filled in, but you can make changes on the fly if needed. You will most likely need to provide important details in the Job Info section, such as job description, job type, job status, and projected end date.

New job form in QuickBooks Pro

After creating the job, you can look at its progress by running job reports, such as Job Profitability Summary, Profit and Loss by Job, and Unbilled Costs by Job.

If you’re selling taxable products and services, you can use QuickBooks Desktop to track sales tax collections and remittances for each state and tax authority. Sales taxes can be added to receipts, estimates, and invoices.

You can run a tax liability report for a certain time period and track tax payment due dates to avoid late filing and penalties. In addition, you can monitor what you owe from the Sales Tax Payable register and the Pay Sales Tax window.

QuickBooks Desktop Pro’s inventory accounting isn’t as enhanced as QuickBooks Premier’s, but it does a great job of monitoring the COGS and calculating ending inventory. You can track the availability of inventory and the average and the total number of items, create purchase orders (POs) for vendors, and set up alerts when you’re running out of inventory.

QuickBooks Pro lets you set up inventory items so that you can track what you have on hand and how much you’ve spent and earned with it. When you sell a product, the program records both purchase (COGS) and sales revenue in a single entry. This helps you easily track and analyze your gross profit and gross margin and whether you are making enough money on a certain item to replenish your inventory. Also, QuickBooks will adjust your inventory in your balance sheet automatically, eliminating the need for manual data entry.

There are three types of items you can add in QuickBooks Desktop: noninventory items, inventory items, and services. Noninventory items are those you purchase but don’t track, such as office supplies, while inventory items are those you purchase, track, and resell. Service items are services you purchase or offer, such as consulting hours and labor fees.

When recording an inventory item in QuickBooks Pro, select Inventory Part and then complete the New Item form that shows up. To set up new inventory, complete important details, such as item name, purchase cost and description, and sales cost and description.

One of the best parts about inventory in QuickBooks Pro is that you can set reorder points. QuickBooks will alert you to replenish your inventory when the item’s count hits the reorder point you specified.

Adding a new inventory item in QuickBooks Pro

We attempted to generate 16 types of reports in QuickBooks Desktop Pro, and the only missing report is profit and loss (P&L) statements by location. QuickBooks Desktop lets you run an array of reports, including P&L statements, cash flow statements, and balance sheets. There are more than 100 reports available, and you can find the list of present reports from the Reports Center:

Report Center in QuickBooks Desktop Pro

If you need to track P&L separately between two locations, you need QuickBooks Online. QuickBooks Pro or any version of QuickBooks Desktop doesn’t offer location tracking.

With a little practice, you may find Pro easy to navigate. From the homepage, you’ll see the workflow navigation chart, which is grouped into Vendors, Customers, Employees, Company, and Banking.

QuickBooks Desktop Pro’s homepage

If you need help, you can talk to one of our agent through live chat or get help remotely .

Reviews

Clear filtersThere are no reviews yet.